Netspend Que Es - Prepaid Debit Card Solutions

So, you've heard a bit about Netspend, perhaps from a friend or maybe even seen it mentioned somewhere, and now you're wondering, "Netspend que es?" Well, it's actually a pretty straightforward idea: a way to handle your money that's a little different from what you might be used to with traditional banks. It's about giving folks a practical payment option, especially for those who might not have, or simply prefer not to have, a regular bank account. This kind of service, you know, can be quite a helpful tool for managing everyday spending and getting payments.

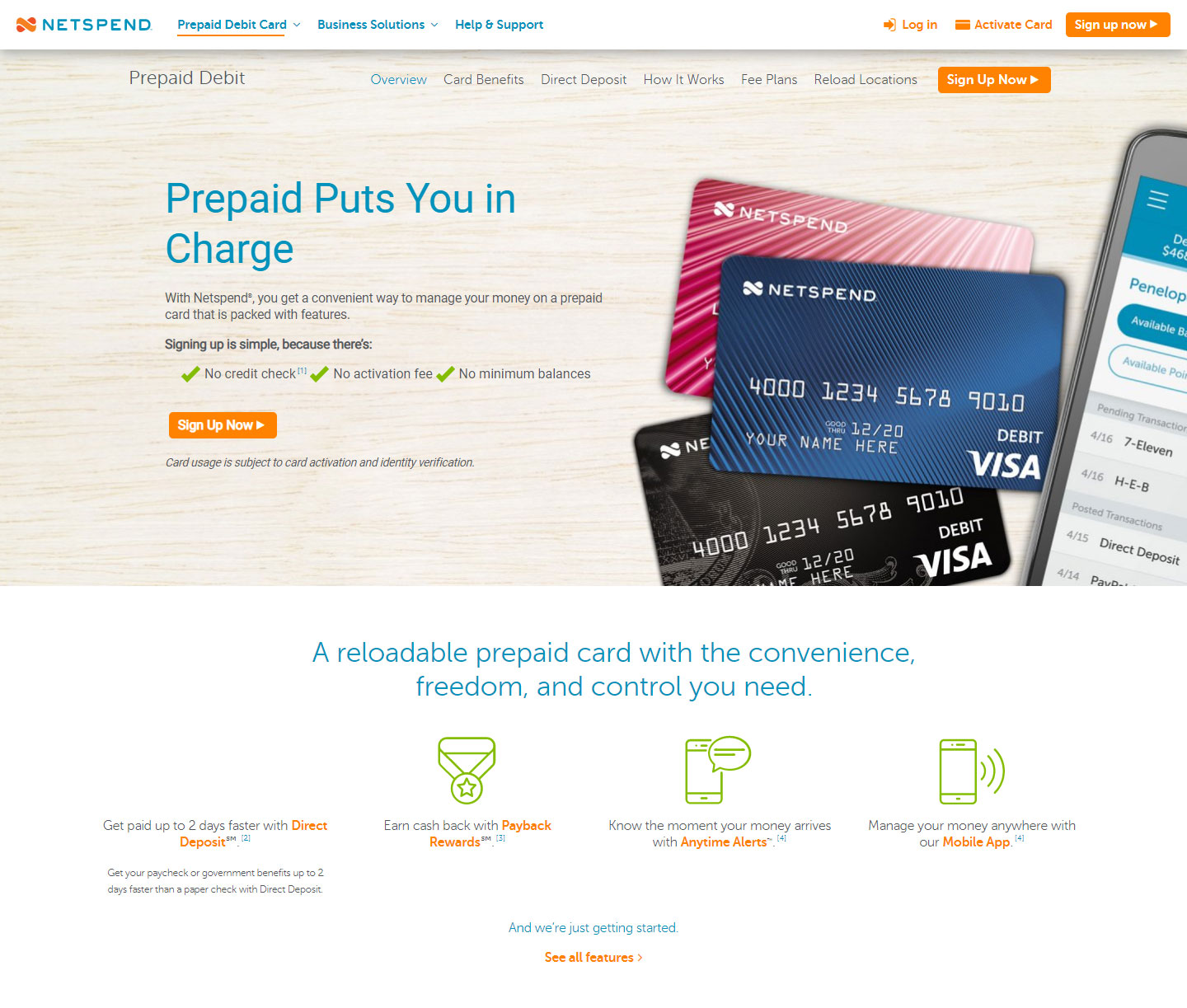

This particular service offers what are called prepaid debit cards, which, in a way, work very much like a regular debit card you might link to a checking account, but without needing that actual bank account. It’s a system where you put money onto the card, and then you can use that money for all sorts of things, like buying groceries or paying bills. It’s a simple concept, really, making it easier for many people to participate in the everyday financial world without jumping through all the hoops that banks sometimes require.

Throughout this article, we'll talk about what Netspend is all about, how it works, and what it might offer someone looking for a different kind of financial solution. We’ll look at how these cards can be used, where you can find them, and some of the features that make them an interesting choice for handling your funds. It's all about getting a clearer picture of this payment system and whether it could be a good fit for your own money needs.

Table of Contents

- ¿Qué es Netspend y Cómo Funciona Realmente?

- ¿Para Quién Podría Ser Útil Netspend?

- ¿Cómo se Usa una Tarjeta Netspend y Dónde Encontrarla?

- ¿Hay Algo Más que Saber Sobre Netspend?

¿Qué es Netspend y Cómo Funciona Realmente?

When someone asks "Netspend que es?", it's good to start with the basics. Netspend is, at its core, a company that provides financial solutions, primarily through prepaid debit cards. These cards are a bit like your standard MasterCard or Visa, meaning you can use them in many of the same places, whether you're shopping online or in a store. What makes them different, you know, is that they aren't tied to a traditional bank account or credit line. You load money onto the card, and that's the money you get to spend. It’s a very direct way to handle your cash.

This company, which has been around since 1999, has grown to be a pretty well-known provider of these kinds of cards in the United States. They offer various types, including Visa, MasterCard, and even corporate prepaid cards. The idea is to give people an alternative to standard banking, especially for those who might find it difficult to open a regular checking or savings account. So, in some respects, it fills a gap for many folks looking for a simple, accessible payment method without the usual bank requirements.

The way it works is actually quite simple. You put money onto the card – you could think of it as loading up a digital wallet. Once the money is there, you can use the card for purchases, just like any other debit card. If your balance gets low, or completely used up, you just add more money to it. Or, if you're done with it, you can simply stop using it. There's no minimum balance to keep, and they don't check your credit history when you apply, which is a really appealing aspect for many individuals, you know, looking for financial flexibility.

- Miss Canada Paternity Test Results Reddit

- Chris Kempczinski

- Abigail Martin Net Worth

- Cisco Adler Net Worth

- Nsfw Ai Generator Perchance

Netspend: Una Mirada Más Cercana a lo que Es

Netspend, as a company, has a main office in Austin, Texas, and has built a solid reputation in the prepaid debit card market. They're seen as a reliable provider, offering a range of products and services that aim to meet different money needs. The core product, the prepaid card, functions as a stand-in for a traditional bank account. This means you can get your paychecks, government benefits, or other payments sent directly to your card, which can be super convenient, honestly, if you don't have a bank account.

One interesting feature that Netspend has offered is a savings account option that pays a pretty good interest rate, sometimes as high as 5%. This is something you don't often see with prepaid cards. However, it's worth knowing that these cards can come with various fees. These fees, you know, could potentially eat into any interest you might earn from the savings feature, so it's something to keep an eye on. It's always a good idea to understand all the costs involved when picking any financial product.

Beyond just spending, Netspend cards also let you do things like withdraw cash from ATMs. Plus, they have a mobile app that allows you to manage your money on the go, making it easier to keep track of your spending and balances. This kind of accessibility, you know, is pretty important in today's world, allowing people to stay on top of their finances from almost anywhere. It's all part of what Netspend tries to offer as a practical alternative.

¿Para Quién Podría Ser Útil Netspend?

When thinking about "Netspend que es" in terms of its usefulness, it becomes clear that this type of card is particularly helpful for certain groups of people. For instance, it's a really good option for individuals who don't have access to traditional banking services. This could be because they don't meet the requirements for a regular bank account, or perhaps they just prefer not to deal with banks for various personal reasons. In these situations, a Netspend card offers a simple way to manage money and make payments.

It's also, you know, become quite popular among immigrants in the United States. For many newcomers, establishing a traditional bank account can be a bit of a hurdle, especially without a long credit history or certain types of identification. A Netspend card offers a straightforward path to financial participation, allowing them to receive wages, pay for things, and manage their daily expenses without the complexities that sometimes come with traditional banking setups. It provides a sense of financial independence, which is really important.

Basically, anyone looking for an alternative to a checking account, or just a simple way to keep their spending separate, might find Netspend to be a good fit. It’s a tool that provides many of the functions of a regular debit card without the need for a bank account. So, whether you're getting paid, needing to pay bills, or just want a convenient way to shop, it could be a very practical choice for managing your money, allowing for a good deal of flexibility.

La Propuesta de Valor de Netspend para Diferentes Personas

The appeal of Netspend, you know, really comes down to its ability to offer a kind of financial freedom for those who might otherwise feel left out of the mainstream banking system. It’s not just about having a card; it’s about having a tool that helps you handle your everyday money matters with ease. For example, being able to receive your salary directly onto the card means you don't have to worry about cashing checks, which can save time and sometimes money on check-cashing fees. This direct deposit feature is, honestly, a big draw for many users.

Moreover, the ability to use the card for online purchases opens up a whole world of shopping and service access that might otherwise be unavailable to someone without a traditional bank card. You can pay bills, subscribe to services, and buy things from the comfort of your home. This convenience is, in some respects, a major benefit. It means you're not limited to cash-only transactions, which can be a real hassle in many situations today.

For those who are just looking for a simple, no-frills payment method, Netspend can be quite appealing. There’s no credit check, no minimum balance to worry about, and you only spend the money you've loaded onto the card. This straightforward approach can be a huge relief for people who want to avoid debt or simply prefer to stick to a cash-based budgeting style, but with the convenience of a card. It’s a very direct way to manage your spending, which can be quite empowering, too.

¿Cómo se Usa una Tarjeta Netspend y Dónde Encontrarla?

Using a Netspend card is, you know, pretty much like using any other debit card you might have come across. Once you've added money to it, you can swipe it, insert it, or tap it at stores that accept Visa or MasterCard. You can also use it for purchases you make online, which is a very common way people shop these days. If you need physical cash, you can take money out at ATMs, which is quite convenient for everyday needs. It’s all designed to be as simple and familiar as possible for the user.

Finding a Netspend card is also relatively easy. You might have seen them advertised on television, or perhaps a friend or family member has mentioned them. They're often available through various retail locations, and in some cases, you can even get one sent to you by mail. This accessibility is part of what makes them so popular; you don't necessarily have to go to a bank branch to get started. It’s a system that’s been set up to be widely available to people who need it, which is pretty helpful.

The company also has a really big network for reloading your card. There are over 130,000 places where you can add money to your Netspend card, which means you're likely to find a convenient spot nearby, no matter where you are. This extensive network is a key part of the Netspend experience, making it easy to keep your card funded and ready for use. It’s a very practical aspect of their service, ensuring that you can always access your money when you need it.

Operando tu Tarjeta Netspend y Su Red de Uso

Operating your Netspend card involves more than just spending; it also includes managing your money effectively. The mobile application that comes with the card allows you to do quite a bit. You can check your balance, review your transaction history, and even send and receive money from others. This kind of control, you know, is really important for staying on top of your finances, giving you a clear picture of where your money is going and what you have available to spend.

The ability to send and receive money directly through the card is a useful feature, especially for those who rely on informal money transfers or need to pay friends and family. It’s a way to move money around without needing a bank account, making it easier to handle personal transactions. This functionality, in some respects, makes the Netspend card more than just a spending tool; it becomes a sort of personal money hub for those who use it regularly.

Because it functions as a prepaid card, you can only spend the amount of money you have loaded onto it. This can be a great way to budget and control your spending, as you can’t accidentally overspend or go into debt. Once the money is gone, you simply reload it. This direct relationship between the money you put in and the money you can spend is, honestly, a very appealing aspect for many people who prefer to stick to a strict budget or avoid credit altogether. It’s a very straightforward financial arrangement.

¿Hay Algo Más que Saber Sobre Netspend?

When considering "Netspend que es" fully, it's good to touch on some additional details that make it a comprehensive financial tool for many. One particular offering is the "Netspend All-Access" card. This card aims to provide a more complete banking experience without the need for a traditional bank account. It gives you access to a range of services, including direct deposit for your income, ways to pay bills, and options for transferring money. It also helps you keep track of your spending and manage your budget, which is pretty useful for daily financial oversight.

The "All-Access" card also comes with rewards and promotions, which can add a little extra value for users. Plus, it includes security and protection features, giving you some peace of mind about your funds. There’s also customer support available to help with any questions or issues you might have. So, it's more than just a basic spending card; it tries to cover many aspects of what a regular bank account would offer, making it a truly alternative financial solution for many people.

Netspend works with banks to issue these prepaid cards to individuals who provide their names and addresses. This partnership with banks helps ensure that the cards function reliably and are accepted widely, just like traditional debit or credit cards. It means that when you use a Netspend card, you're tapping into a system that is recognized and trusted by merchants and financial institutions. This broad acceptance is, you know, a very important factor for any payment method you choose to use regularly.

Detalles Importantes sobre Netspend y Sus Características

One of the reasons Netspend has gained popularity is because it offers a very accessible way to handle money, especially for those who might find traditional banking a bit out of reach. The fact that you can often receive these cards by mail makes them incredibly convenient to acquire. You don't necessarily have to go through a lengthy application process or meet strict financial criteria. This ease of access is, honestly, a significant advantage for many potential users who are looking for a quick and simple solution.

While the Netspend card offers many benefits, it’s also important to be aware of its fee structure. As mentioned earlier, some of the cards can have fees that, in some respects, might add up and potentially offset any interest earned from a linked savings account. These fees can vary depending on the specific card type and how you use it. It’s always a good idea to read the terms and conditions carefully to understand all the potential costs involved, so you can make an informed choice about whether it’s the right fit for you.

Overall, Netspend is a company that provides a valuable alternative in the financial services landscape, particularly in the United States. It offers prepaid debit cards that function much like traditional bank cards, allowing users to make purchases, withdraw cash, and manage their money without needing a standard bank account. With features like direct deposit, a mobile app, and a large reload network, it aims to provide a convenient and accessible financial tool for a wide range of individuals. It's a very practical option for those seeking flexibility in how they handle their everyday funds.

Prepaid Debit Cards | Business Prepaid Cards | Netspend

![17 Best Virtual Card Providers for Business Spending [2025]](https://geekflare.com/wp-content/uploads/2024/06/netspend-logo.jpg)

17 Best Virtual Card Providers for Business Spending [2025]

Netspend Login – Sign In to Netspend Prepaid Account