Understanding The Difference Between BYDDF And BYDDY

It's a common thing for folks to feel a little puzzled when they first try to make sense of BYD stock, especially with those two ticker symbols, BYDDF and BYDDY, floating around. You know, it can really throw someone off, trying to figure out what sets them apart when they both seem to point to the same company. This kind of confusion is, well, pretty typical for anyone looking to put their money into something like this for the first time, or even for seasoned investors who just haven't looked at this particular situation before.

You see, both BYDDF and BYDDY are, in fact, connected to the very same business: BYD Company Limited, a rather big player in the electric vehicle world based in China. It's the same company that a very well-known investor, Warren Buffett, has put some of his funds into, which, you know, makes it quite interesting for many people. Yet, despite being for the same company, if you glance at their current prices, you'll find BYDDF sitting around $24.50 and BYDDY at about $47.50, which, basically, looks like a pretty big gap for the same thing, doesn't it?

So, what's really going on here? Why the different prices, and what does it mean for someone like you who might be thinking about buying shares? Well, we're going to walk through what makes these two tickers distinct, touching on things like where they trade, how easy it is to buy and sell them, and even a bit about how rules might affect them. It's all about helping you get a clearer picture, so you can pick what feels right for your own money moves.

Table of Contents

- What is BYD, Anyway?

- BYDDF and BYDDY - What's the Core Difference?

- How Do Trading Platforms Show a Difference Between BYDDF and BYDDY?

- Considering Liquidity and Its Difference Between BYDDF and BYDDY

- What About Regulatory Oversight and the Difference Between BYDDF and BYDDY?

- Sponsored Versus Unsponsored - A Key Difference Between BYDDF and BYDDY

- Why the Price Difference Between BYDDF and BYDDY?

- Making Your Choice - The Difference Between BYDDF and BYDDY for You

What is BYD, Anyway?

Before we get too deep into the ticker symbols, it helps to know a little about the company itself. BYD Company Limited is a Chinese business that has, you know, made a real name for itself in electric vehicles. They make cars, buses, and even electric bicycles. It's a company that has been around for a while, and they've really pushed to be at the forefront of electric transport. They're also into things like battery production, which, basically, ties into their whole electric vehicle operation.

A lot of people probably heard about BYD because of a very famous investor, Warren Buffett. His company, Berkshire Hathaway, put money into BYD quite some time ago, and that really put BYD on the map for many folks outside of China. This kind of backing, you know, from someone with such a good track record, tends to make a lot of people curious about the company and its shares. It gives it a certain kind of weight, you could say, in the investment world. So, when you see BYDDF or BYDDY, just remember, you're looking at a piece of that very same business.

BYDDF and BYDDY - What's the Core Difference?

So, you've got BYDDF and BYDDY, both representing shares in the same big electric vehicle company. This can feel a little confusing, as I was saying, because on the surface, they look like they should be the same thing, especially when you see them both trading in the United States. And, actually, they both do trade over the counter, or OTC, in the U.S. market, which means you can buy them using U.S. dollars. This is pretty convenient for many American investors, naturally.

- Sean Penn Maladie

- Kirstentoosweet Nude Onlyfans

- Alfie Allen

- Miss Canada Paternity Test Results Reddit

- Chloe Bennet

However, the real puzzle, the core difference between BYDDF and BYDDY, comes down to where their primary listing is and how they're set up for trading across borders. One of them, BYDDY, is actually listed on the Hong Kong Stock Exchange. The other, BYDDF, is essentially a different way for U.S. investors to get a piece of the company without going through the Hong Kong market directly. It's like having two different doors into the same building, and each door has its own set of rules and characteristics, you know, that might make one a bit more appealing than the other depending on what you're looking for.

How Do Trading Platforms Show a Difference Between BYDDF and BYDDY?

The main way these two tickers show their difference between BYDDF and BYDDY is through where they are primarily traded. BYDDY, as we just talked about, has its main home on the Hong Kong Stock Exchange. This means it follows the rules and ways of doing things that are common in that market. For investors in the U.S., BYDDY is usually available as an American Depositary Receipt, or ADR, which is basically a certificate that represents shares in a foreign company, making it easier to trade here. So, it's a way for U.S. folks to own a bit of a company listed far away, without all the fuss of trading directly on a foreign exchange.

On the other hand, BYDDF is mostly traded over the counter in the U.S. This means it doesn't have a listing on a major exchange like the New York Stock Exchange or Nasdaq. OTC markets are a bit different; they're more like a network of brokers and dealers who trade directly with each other. For some people, this might feel a little less formal, perhaps, than trading on a big, well-known exchange. This difference in where they trade, you know, can have an impact on how easily you can buy or sell shares, and even on the kind of information that's readily available about them. It's a key part of the difference between BYDDF and BYDDY.

Considering Liquidity and Its Difference Between BYDDF and BYDDY

When we talk about liquidity, we're basically talking about how easy it is to buy or sell something without really changing its price. This is a pretty big part of the difference between BYDDF and BYDDY. Shares that are highly liquid are like water; you can pour them in and out of a cup very easily. Shares with lower liquidity are more like honey; they move a bit slower. So, for BYDDF, which is an OTC stock, it might feel like there aren't as many folks looking to buy or sell at any given moment, which could mean it takes a little longer to get your shares sold, or maybe you don't get exactly the price you hoped for right away, you know?

BYDDY, because it's tied to a listing on the Hong Kong Stock Exchange, tends to have more trading activity, generally speaking. This means there are often more buyers and sellers around, which can make it easier to get your orders filled quickly and at a price that's closer to what you expect. For someone who might need to sell their shares in a hurry, or who just likes the idea of a very active market, this difference in how easily shares can change hands is, well, pretty important. It's a practical consideration that really sets apart the difference between BYDDF and BYDDY for many investors.

What About Regulatory Oversight and the Difference Between BYDDF and BYDDY?

Another aspect that shows a difference between BYDDF and BYDDY is the level of regulatory oversight each one experiences. Regulatory oversight basically refers to the rules and watchdogs that keep an eye on how stocks are traded and how companies share information. For BYDDF, being an OTC stock, it might come with a bit less direct regulatory scrutiny compared to a stock listed on a major exchange. This isn't necessarily a bad thing, but it means that the information you get, or the way the company reports things, might not always be as standardized or as frequent as what you'd see from a company listed on, say, the New York Stock Exchange. It's just a different environment, you know?

BYDDY, on the other hand, being connected to the Hong Kong Stock Exchange, falls under the rules and regulations of that market, as well as the U.S. rules for ADRs. This often means there's a bit more formal reporting and a different kind of transparency that investors might be used to. Some investors might feel more at ease with shares that have more eyes on them, so to speak, from regulatory bodies. Others might be perfectly fine with the OTC environment. It really just depends on what makes you feel comfortable when you're putting your money somewhere. This difference in how much regulatory attention they get is a pretty clear part of the difference between BYDDF and BYDDY.

Sponsored Versus Unsponsored - A Key Difference Between BYDDF and BYDDY

This might sound a bit technical, but the idea of "sponsored" versus "unsponsored" can be a pretty important difference between BYDDF and BYDDY, especially for how they trade in the U.S. An "unsponsored" ADR, which is what BYDDY is sometimes listed as, means that the foreign company, BYD in this case, hasn't directly set up or paid for the ADR program in the U.S. Instead, a depositary bank, like a big financial institution, has created the ADRs on its own, based on shares it bought in the foreign market. This means the company might not have as much direct involvement with the U.S. investors holding those ADRs, you know, in terms of providing specific information or communicating directly.

A "sponsored" ADR, in contrast, would mean the foreign company itself has a direct agreement with a depositary bank to issue the ADRs. They usually pay for the program and have a say in how information is shared with U.S. investors. While the source text indicates BYDDY might be unsponsored, it's a good point to consider how this setup affects things like shareholder communication, dividend payments, and even voting rights. This distinction, whether the company is actively supporting the U.S. trading of its shares or if it's more of a bank-driven initiative, is a subtle yet important aspect of the difference between BYDDF and BYDDY for those who pay close attention to these kinds of details. It can, basically, affect how connected you feel to the company as a shareholder.

Why the Price Difference Between BYDDF and BYDDY?

It's pretty natural to wonder why BYDDF is priced around $24.50 and BYDDY is closer to $47.50, especially when they represent the same company. This price difference is a pretty clear sign of the difference between BYDDF and BYDDY. One reason for this can be the number of underlying shares each ADR represents. For example, one BYDDY ADR might represent a different number of actual BYD shares traded in Hong Kong than one BYDDF share. The source text mentions that BYDDY trades at about "2x BYDDF," which suggests there's a relationship there, possibly related to how many shares each ticker stands for, or maybe some kind of conversion rate.

Another factor could be the exchange rate between the Hong Kong Dollar (HKD) and the U.S. Dollar (USD). The source mentions BYDDF trading at an HKD:USD conversion rate. So, the prices you see in the U.S. for both BYDDF and BYDDY are converted from the Hong Kong share price. Differences in how these conversions are handled, or even just the simple fact that they represent different "packages" of the underlying shares, can lead to these price variations. It's a bit like buying a bag of apples; one bag might have five apples for a certain price, and another might have ten for a different price, but they're all still apples. The way these different "packages" are put together contributes to the noticeable difference between BYDDF and BYDDY in their listed prices.

Making Your Choice - The Difference Between BYDDF and BYDDY for You

Ultimately, picking between BYDDF and BYDDY really comes down to what you, as an investor, are looking for. There's no single "better" option, just the one that feels more right for your own personal preferences. For instance, if you're someone who is okay with shares that might not trade as often, and you're comfortable with a bit less direct regulatory oversight, then BYDDF, being an OTC stock, might be a good fit. It's more about being comfortable with a slightly different way of doing things, you know, compared to a big exchange.

On the other hand, if you prefer something that tends to have more trading activity, or if you feel more secure with the kind of rules that apply to a major stock exchange, then BYDDY might be more up your alley. It's about weighing things like how easily you can buy and sell, how much information you get, and even how taxes might work out for you. To make a decision that really fits your situation, it's a good idea to look at things like how each one has performed over time, how much risk seems to be involved, and any costs tied to owning them. Thinking about these points, and what matters most for your own money plans, will help you sort out the difference between BYDDF and BYDDY and choose the one that aligns with your portfolio strategy.

So, we've walked through the key points that show the difference between BYDDF and BYDDY. We started by looking at BYD, the company itself, a big name in electric vehicles that Warren Buffett has put money into. Then, we talked about how BYDDF and BYDDY are both ways to own a piece of this company, but they have distinct features. We explored how their trading platforms, with BYDDF on the OTC market and BYDDY tied to the Hong Kong Stock Exchange, create a noticeable split. We also considered what liquidity means for each, how regulatory oversight plays a part, and the idea of sponsored versus unsponsored setups. Finally, we touched on why their prices might look different and how your own preferences can guide your choice between these two tickers. It's all about making an informed decision that feels right for you.

- How Old Is Paula Deen

- Goblin Cave Anime Wiki

- Ines De Ramon

- Nsfw Ai Generator Perchance

- How Old Is Sean Penn

【differenceとdifferentの違いを解説】簡単な覚え方や関連表現を紹介 - ネイティブキャンプ英会話ブログ | 英会話の豆知識や情報満載

Differ Definition & Meaning | YourDictionary

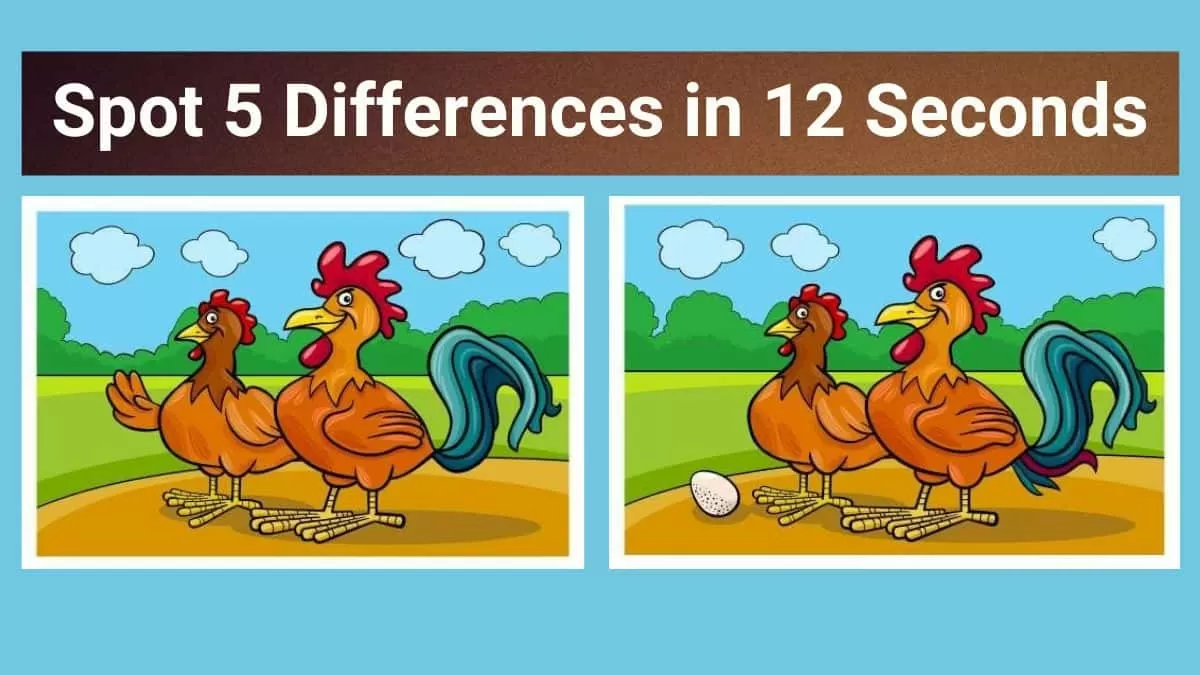

Spot The Difference: Can you spot 5 differences between the two