BYD Stock - Spotting The Difference BYDDF And BYDDY

Figuring out how to buy a piece of BYD, the well-known electric vehicle maker from China, can feel a little puzzling for some folks who are thinking about investing. You might see two different names pop up: BYDDF and BYDDY. It's pretty common to wonder what sets these two apart, especially when you are just trying to get a handle on things.

You see, both of these ticker symbols, BYDDF and BYDDY, are actually connected to the very same company, BYD. This is the big Chinese electric vehicle business that, as a matter of fact, has received some attention for being an investment choice of Warren Buffett. So, in a way, you are looking at the same company, just through different windows, so to speak.

The main thing to keep in mind is that while they point to the same company, the way you buy and sell them, and what that means for you, can vary quite a bit. It is about where they are traded, how easy it is to move your money around, and some other details that could make one a better fit for what you are hoping to do with your money. We are going to walk through what makes each one unique, so you can feel a little more sure about what you are looking at.

- Gene Wilder Grandchildren

- Barron Trump Marfan Syndrome

- How Much Is Courteney Cox Worth

- Goblin Cave Anime Wiki

- Has Lil Tecca Ever Been To Jail

Table of Contents

- What's the Story with BYD Stock?

- What is the difference between BYDDF and BYDDY - The Core Idea

- How Does BYDDF Work?

- What is the difference between BYDDF and BYDDY - Thinking About BYDDF

- What About BYDDY?

- What is the difference between BYDDF and BYDDY - Considering BYDDY

- Which One Might Suit You?

- What is the difference between BYDDF and BYDDY - Making a Choice

What's the Story with BYD Stock?

When people talk about BYD, they are referring to a company that has made a name for itself in the world of electric vehicles. It is a big player in China, and its presence has been growing. The fact that someone like Warren Buffett put some money into it has, you know, certainly added to its profile. So, it is a company that many people are keeping an eye on, perhaps for good reason. Trying to get a piece of a company like this, especially one based in a different country, can sometimes present a few options, and those options can look a little different.

For someone looking to get involved, seeing BYDDF and BYDDY pop up can be a bit of a head-scratcher. It is almost like trying to pick between two paths that seem to lead to the same destination, but the paths themselves have different features. One might be a smoother walk, while another could have a few more bumps, or perhaps a different view. The key is to understand what those differences are, so you can pick the path that feels most comfortable for you and your investment goals. It is about making a choice that makes sense for your personal situation, in some respects.

Both of these options let you own a part of BYD Company Limited. However, the ways they are set up, the places where they are bought and sold, and even some of the rules that apply to them, are not the same. This means that while the underlying company is identical, the experience of holding one versus the other can vary. We will go into more detail about these distinctions, helping to clear up any lingering questions about what is the difference between BYDDF and BYDDY.

- Kirstentoosweet Onlyfans

- Rosanna Scotto Net Worth

- Beatrice Milly

- Nsfw Ai Generator Perchance

- Raf Sanchez Wiki

What is the difference between BYDDF and BYDDY - The Core Idea

At its heart, the main thing that sets BYDDF and BYDDY apart comes down to where and how they are traded. Think of it like this: you want to buy a specific type of fruit, but you can get it from a local market or a big, international grocery store. The fruit is the same, but the shopping experience, the prices, and maybe even the way it is packaged, could be quite different. This is very similar to how these two stock options work for BYD. One is typically found on what is called the "over-the-counter" market, while the other is generally listed on a major stock exchange in Hong Kong.

The "over-the-counter" market, often called OTC, is a bit less formal than a big stock exchange. It is more about direct dealings between buyers and sellers, often through a network of brokers. This can sometimes mean that it is a little harder to buy or sell a lot of shares quickly, because there might not be as many people looking to trade at any given moment. That is one of the key points when we think about what is the difference between BYDDF and BYDDY. It is about how easily you can get in and out of your position, which is called liquidity.

On the other hand, a listing on a major stock exchange, like the Hong Kong Stock Exchange, usually means there are more people trading, more rules in place, and generally, it is easier to buy and sell shares without big price swings. This often makes for a more predictable trading environment. So, when you are trying to figure out what is the difference between BYDDF and BYDDY, these trading venues are pretty central to the whole story. It is a really important distinction for anyone thinking about putting their money into BYD.

How Does BYDDF Work?

Let's take a closer look at BYDDF. This ticker symbol is generally associated with shares that trade on the OTC market. What this means for someone looking to invest is that the way these shares are bought and sold is a little different from what you might be used to with a big, well-known stock exchange. It is not quite as centralized, so to speak. This setup can have some effects on how you experience owning these shares, too.

One of the main things people consider with OTC stocks like BYDDF is what is known as liquidity. Simply put, liquidity refers to how easily you can buy or sell shares without causing a big change in their price. With OTC stocks, there might be fewer buyers and sellers at any given time compared to a major exchange. This could mean that if you wanted to sell a large number of shares quickly, it might take a little longer, or you might have to accept a price that is not quite what you hoped for. It is just a characteristic of that particular market, you know.

Another point that often comes up with OTC stocks is the level of regulatory oversight. Generally, these markets have less strict rules and reporting requirements compared to major exchanges. For some investors, this might not be a big deal, but for others, it is something they pay attention to. It is about how much information is readily available and how many formal protections are in place. So, when you think about what is the difference between BYDDF and BYDDY, the OTC nature of BYDDF is a pretty big piece of that puzzle, offering a certain kind of experience for those who choose it.

What is the difference between BYDDF and BYDDY - Thinking About BYDDF

When considering BYDDF, it is helpful to keep in mind that its trading environment, the OTC market, often means a particular set of conditions. For instance, the prices you see for BYDDF might not always move as smoothly as shares on a larger exchange, because there are fewer transactions happening. This can sometimes lead to what people call wider "bid-ask spreads," meaning there is a bigger gap between the price someone is willing to buy at and the price someone is willing to sell at. It is just a part of how that market operates, actually.

The convenience factor can also play a role. While many brokerage accounts can handle OTC trades, the process might feel a little different or involve slightly different fees than trading on a major exchange. It is something to check with your specific brokerage, of course. Some people might find it perfectly straightforward, while others might prefer the more standardized feel of a major exchange. This is part of the ongoing conversation about what is the difference between BYDDF and BYDDY.

For certain types of investors, particularly those who are quite comfortable with markets that have a bit less daily activity and different regulatory structures, BYDDF might be a suitable choice. It offers a way to get exposure to BYD, the company, but through a trading path that has its own distinct characteristics. Understanding these points is pretty important for anyone weighing their options, as it helps to set expectations for how the investment might behave over time.

What About BYDDY?

Now, let's turn our attention to BYDDY. This ticker symbol is generally linked to shares of BYD that are listed on the Hong Kong Stock Exchange. This is a very different setup from the OTC market where BYDDF trades. A major stock exchange like Hong Kong's has a lot more formal structure, and that often translates into a different kind of trading experience for investors. It is like comparing a local farmers' market to a large, established supermarket, in a way.

One of the big advantages of a listing on a major exchange is usually higher liquidity. This means there are typically many more buyers and sellers active throughout the trading day. If you want to buy a lot of shares, or sell them quickly, it is generally much easier to do so without significantly impacting the price. This can provide a greater sense of flexibility for investors, which is a key point when we think about what is the difference between BYDDF and BYDDY.

Furthermore, stocks traded on major exchanges are typically subject to more stringent regulatory oversight and reporting requirements. This means that the company has to provide more detailed and regular information to the public, and there are more rules in place to protect investors. For many people, this added layer of transparency and protection is a very comforting aspect. It helps to build a sense of trust in the market itself, you know, which is something many investors value quite a bit.

What is the difference between BYDDF and BYDDY - Considering BYDDY

When you consider BYDDY, you are generally looking at a more conventional way to invest in a company, especially one based outside of the United States. The Hong Kong Stock Exchange is a significant global market, and that brings with it certain expectations about how things operate. The trading hours, the settlement processes, and the overall market conventions might feel more familiar to those used to trading on large, established exchanges around the world. It is a more structured environment, basically.

Another aspect that comes up when comparing BYDDY to BYDDF is how they might handle things like dividends and tax implications. While both represent ownership in BYD, the specific rules around how dividends are paid out, and how those payments might be taxed depending on where you live, can vary. It is always a good idea to look into these details, as they can certainly affect your overall return. This is a pretty important piece of the puzzle when we talk about what is the difference between BYDDF and BYDDY.

For investors who prioritize higher liquidity, a more regulated trading environment, and perhaps a more familiar trading experience, BYDDY might be the preferred choice. It offers a direct way to own shares in BYD through a well-established global stock market. The current prices can also vary significantly, as the text notes, with BYDDY trading at a higher price per share than BYDDF at certain points, reflecting different share structures or trading mechanisms. It is something to keep in mind, of course, when making your decision.

Which One Might Suit You?

Deciding between BYDDF and BYDDY really comes down to what you are looking for as an investor. There is no single "better" option, as each has its own set of characteristics that might appeal to different people. It is about matching the investment to your own comfort level and what you hope to achieve. For instance, some people might be perfectly fine with the particular features of an OTC stock, while others might prefer the more traditional route of a major exchange listing. It is a matter of personal preference, you know.

If you are someone who values being able to buy and sell shares quickly, with lots of activity in the market, and you appreciate the added layers of rules and transparency that come with a major stock exchange, then BYDDY might be a more appealing choice. It offers that kind of environment, which many investors find reassuring. It is about having that sense of ease when you need to make a move, which is a pretty common desire.

On the other hand, if you are comfortable with a market that might have less daily trading volume and a different level of oversight, and perhaps you are looking for a way to access BYD through a different avenue, then BYDDF could be something to consider. It offers a direct connection to the company through the OTC market. The key is to understand these distinctions fully before making any commitments. It is really about aligning your investment choice with your own approach to the market, basically.

What is the difference between BYDDF and BYDDY - Making a Choice

When it comes to making a choice about what is the difference between BYDDF and BYDDY, it is helpful to think about a few things. Consider how important liquidity is to you. Do you need to be able to get in and out of your position very quickly, or are you looking at a longer-term hold where speed is not as critical? This can certainly guide your decision. The ease of trading is a big part of the overall experience, after all.

Also, think about your comfort with regulatory environments. Some investors prefer the added protections and extensive public reporting that come with a major exchange listing, while others might be less concerned about those aspects. It is a personal preference, but one that can have real implications for how you feel about your investment. This is a pretty important consideration for many people, actually.

Finally, it is always a good idea to compare these options across various financial measures, such as their past performance, the risks involved, any costs tied to them, and whether they offer dividends. Looking at these details can help you determine which one might fit better with your overall plan for your money. Both BYDDF and BYDDY offer a way to own a piece of BYD, but they do so through different paths, and understanding those paths is what really matters.

- Larry Fink House Aspen

- Lecy Goranson

- Robert Duvall Net Worth

- Kirstentoosweet Onlyfans

- Zoe Perry Husband

【differenceとdifferentの違いを解説】簡単な覚え方や関連表現を紹介 - ネイティブキャンプ英会話ブログ | 英会話の豆知識や情報満載

Differ Definition & Meaning | YourDictionary

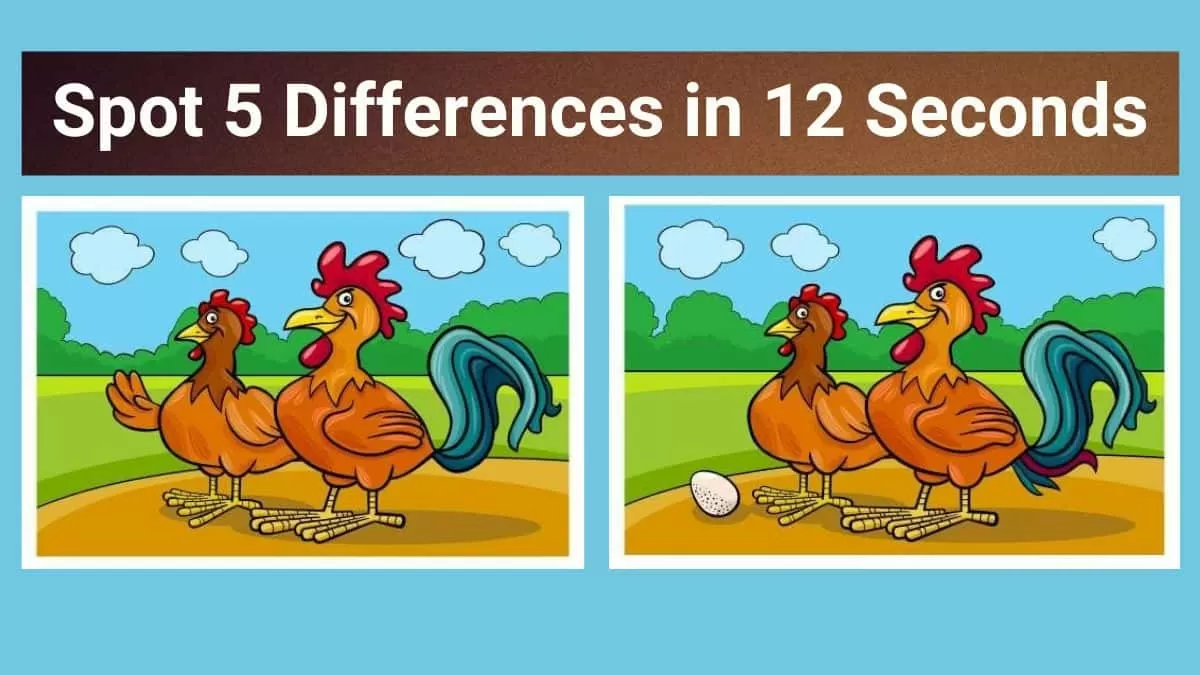

Spot The Difference: Can you spot 5 differences between the two